Accounts payable days is a financial metric that measures the average number of days a company takes to pay its suppliers, vendors, or financiers. The metric, often referred to as A/P days or days payable outstanding (DPO), is typically calculated either quarterly or annually. It measures the time (in days) between a credit purchase from a supplier and payment of the outstanding invoice.

How to Calculate Accounts Payable Days

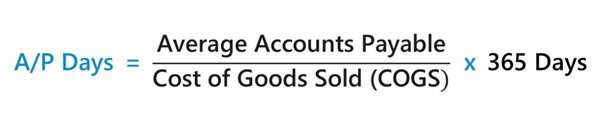

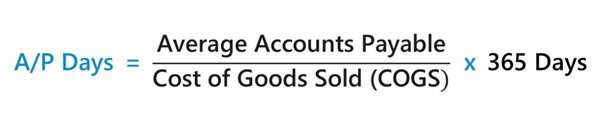

The accounts payable days formula is as follows:

Before we move forward with a sample calculation, it is important to define the key terms:

Average Accounts Payable – the average amount a company owes to suppliers over a certain period. It can be found by adding the accounts payable balance at the start and end of the period and then dividing by 2.

Cost of Goods Sold (COGS) – the money a business must spend to create, handle, and deliver products to customers. Examples of costs include raw material purchases and employee wages.

365 Days – for the purposes of this explainer, we’ll use 365 days to represent an annual accounts payable calculation.

Accounts Payable Days Calculation

Suppose a staff member in a finance company wants to calculate AP days over the last 12 months. The accounts payable balance was $400,000 at the start of the period and at the end, it had increased to $650,000. Based on this, we can calculate the Average Accounts Payable as $525,000. COGS purchases were $3,500,000 over the same period.

To calculate accounts payable days, we divide $525,000 by $3,500,000 to arrive at 0.15. Next, we take 0.15 and multiply it by 365 to yield 54.75. This means that on average, the company takes around 55 days to pay its suppliers.

How to Interpret Accounts Payable Days

Interpreting the accounts payable days metric depends on the context. In some cases, AP days has an inverse relationship with financial and operational performance while in other cases, there is a direct relationship.

Direct Relationships

AP days has a direct relationship to the amount of cash a business has tied up in working capital. Companies that take longer to pay their suppliers keep cash in the business for longer and improve their short-term cash flow. Companies with a lower AP number make faster payments to suppliers. But this comes with less available cash and potential liquidity constraints.

While unpaid invoices must eventually be paid, the company is free to use the cash in the meantime for other purposes. In this way, one can think of accounts payable days as the duration of a short-term, no-interest loan provided by the supplier.

Inverse Relationships

One context where an inverse relationship exists between AP days and operational performance is supplier relationships. Companies with a higher AP days number may strain relationships with suppliers because they take longer to pay (particularly if payment is overdue). This can result in less favorable terms, late fees, and supply chain disruptions.

On the other hand, companies that pay their invoices quickly foster more desirable relationships with suppliers and may be able to access better payment terms or early payment discounts.

Striking a Balance Between Cash Flow and Supplier Relationships

As with many things in life and indeed in business, a balance must be struck between:

To achieve this balance, accounts payable teams need to understand their AP workflows in detail. Higher DPO numbers always need further investigation. Is the company legitimately struggling to meet its expenses, or has the money been set aside for a short-term investment or to increase working capital?

Teams must also be aware of the drivers of low DPO numbers. The company may sacrifice the above investment strategy in favor of one that enables it to access supplier discounts and improve production efficiency. However, it is important to determine whether the early payment discount is more substantial than the interest the company would earn by delaying payment and using the money elsewhere.

In either case, AP teams can use accounts payable automation software to analyze financial data and make timely decisions based on current cash flow and production needs.

Days Payable Outstanding Benchmarks

DPO benchmarks offer companies a reference point with which they can compare their accounts payable performance. The benchmark is an average derived from analysis of the company's industry peers and is often expressed as a number of days. However, it can also be expressed as a range of days.

DPO benchmarks can be found in financial databases and industry reports. They may also be reported by financial consulting firms, trade associations, regulatory bodies, and market research firms in specific industries. Specialist advisory firm McGrathNicol, for example, reported in 2023 that the DPO benchmark for Transport & Logistics companies was 71.4 days.

The significance of a company comparing its DPO number to an industry benchmark cannot be understated. If the company pays its suppliers too early, it reduces working capital which could be used to further other strategic objectives. The company may also indirectly fund the competition. Consider two coffee chains that use the same bean supplier. Coffee chain A pays the supplier every 20 days on average, while coffee chain B pays every 45 days.

In effect, by paying early, coffee chain A enables the supplier to accept longer payment terms from coffee chain B. The second coffee company also has an extra 25 days to put its money to work and may secure a competitive advantage as a result.

How Do Investors Assess Accounts Payable Days?

Investors closely examine the accounts payable days metric as part of their overall assessment of a company's financial health and operational efficiency. Generally speaking, the metric clarifies how effectively a company manages:

Cash flow – a higher DPO number may mean a better ROI if supplier relationships remain positive and liquidity is not an issue.

Operational efficiency – investors also compare a company with industry peers to determine its efficiency. DPO numbers well above the average may suggest an unsustainable cash retention strategy.

Supplier relationships – companies that maintain good terms with suppliers are less likely to experience supply chain friction and instability.

Financial strategy – DPO also provides insight into the company's broader strategy and its approach to the management of liabilities and liquidity. For the investor, these are crucial parts of a company's long-term stability and thus attractiveness as an investment.

The Accounts Payable Turnover Ratio

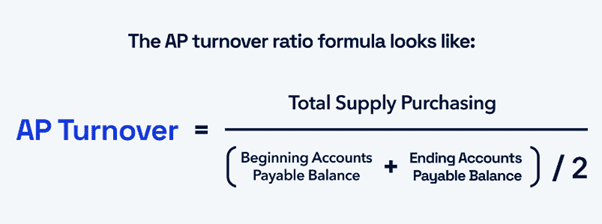

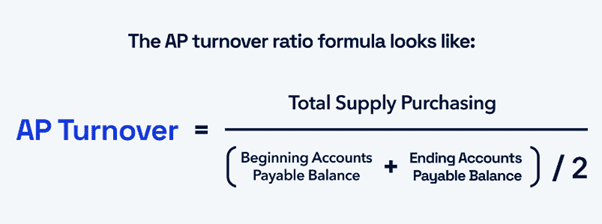

Investors may use the accounts payable turnover ratio (APTR) to delve deeper into how the company manages its AP. In essence, the APTR measures the speed with which a company pays its suppliers over a specific period.

Here, it’s important to differentiate between total supply purchases and the cost of goods sold (COGS) – which was used in the accounts payable formula earlier. COGS represents the direct costs attributable to the production of goods sold by a company. However, total supply purchases encompass all costs over the same period, regardless of whether they were used in the production of goods or remain unused in inventory.

As a result, think of total supply purchases as equal to the COGS plus the inventory at the end of the period minus the inventory at the start of the period. While the accounts payable days formula calculates how long a business takes to pay suppliers, the result of an APTR calculation tells investors how many times the business pays suppliers over the same period.

Investors can use this information to determine if a company has the cash or revenue required to meet short-term obligations. Creditors, on the other hand, can use the APTR formula to gauge a company’s liquidity, cash management, and overall creditworthiness.

Summary:

Accounts payable days is a financial metric that measures the average number of days a company takes to pay its suppliers. It is crucial for understanding a company's cash flow management, operational efficiency, and financial health.

To calculate accounts payable days, divide the average amount the company owes to suppliers over a specific period by the cost of goods sold (COGS). This number must then be multiplied by the number of days. If calculating annually, this number is 365.

Balancing cash flow with supplier relationships in accounts payable is crucial for maintaining a company's financial stability, operational efficiency, and overall business relationships. Ultimately, businesses must receive maximum ROI on their funds without alienating suppliers.

Days payable outstanding (DPO) benchmarks enable companies to compare accounts payable strategies with industry peers and standards. Among other things, DPO benchmarks clarify whether a business is paying suppliers too early and relinquishing a competitive advantage in the process.