How it works

Platform

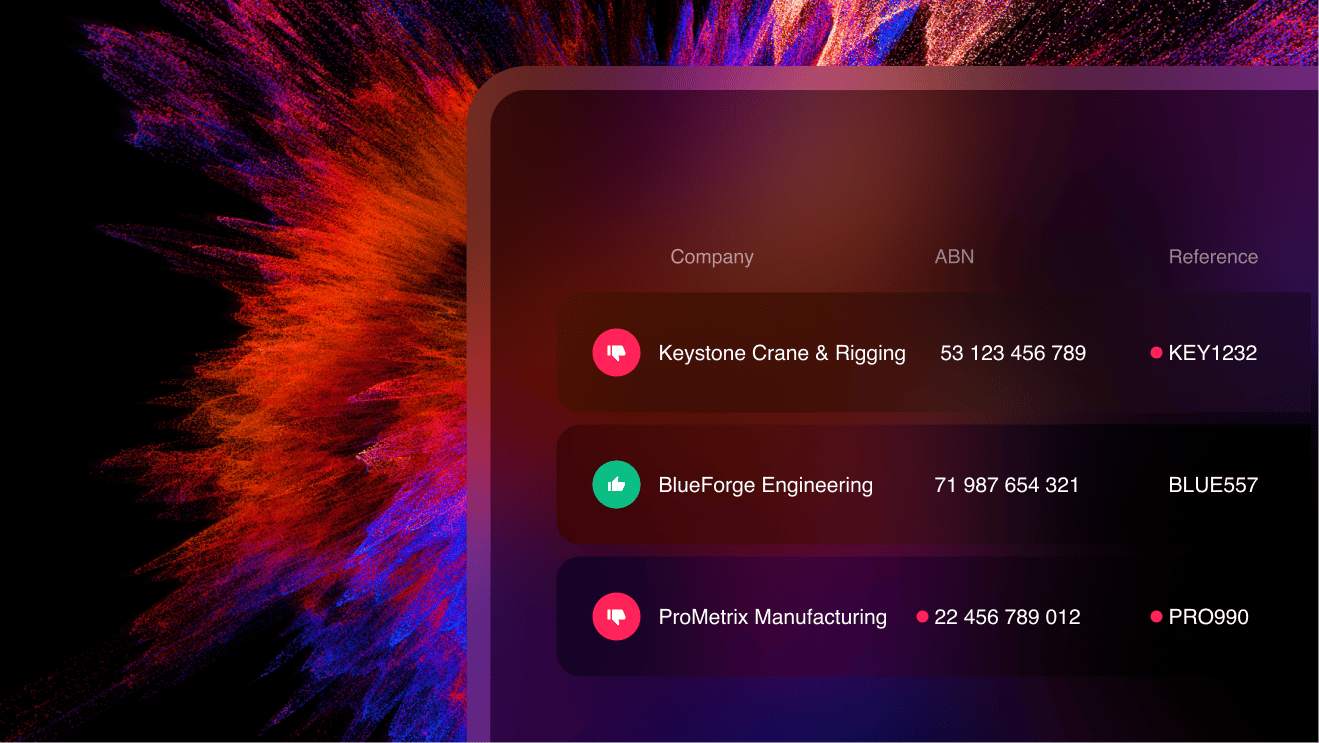

Vendor Management

Onboard, verify and manage suppliers

Payment Protection

Prepare, and pay with certainty

Segregation of Duties

A digital interface to manage visibility and assigned tasks

Audit and Report

Centralise reporting to reduce audit stress

Integrations

Robust integration capabilities with various platforms

By Role

By Threat

AI Deepfake fraud

Safeguard against AI deepfakes

Business Email Compromise

Advanced protection against Business Email Compromise

Insider Threat and Internal Fraud

Detect and deter internal fraud risks

CEO and executive impersonation fraud

Identify and block impersonation attempts

Invoice Fraud

Keep payments safe from fraud

Learn

Blog

Articles and news covering payment fraud

Guides

Learn more about cybercrime and accounts payable processes

Statistics

Access the latest industry statistics

Video Library

Find all our videos in one place

Resource Hub

All our content in one place

Data Breach Checker

Has your email been in a data breach?

Deepfake Assessment

Are you ready for deepfake fraud?

Cybersecurity Training

We’ve partnered with Cyber Wardens to help you build cyber confidence