ASIC Form 388 is one of the documents used to report information to the Australian Securities and Investments Commission (ASIC).

There are multiple types of ASIC forms. One type relates to the registration of a new company, for example, while another is used to notify ASIC of changes to company details such as its name or office address.

The focus of this article will be Form 388 – a key part of the annual financial reporting requirements of some Australian and foreign-owned entities.

Form 388 is a cover sheet that accompanies the financial statement and associated reports of the disclosing entity. All documents and the obligations that underpin them adhere to the relevant sections of the Corporations Act 2001.

Some of the components of the form include:

Company name and Australian Company Number (ACN).

The contact details of a designated individual should ASIC have any queries about the form.

The reason for lodgement. For example, an entity may need to amend a financial statement or has been requested by ASIC to lodge statements and reports.

The start and end dates of the financial year.

Additional information about large proprietary companies that are not disclosing entities.

An auditor’s or reviewer’s report.

Details of the current auditor(s).

Documents required to be attached to Form 388, such as a cash flow statement, balance sheet, directors’ report, directors’ declaration, and the company’s financial position at the end of the year.

A signature and declaration that the attached documents are true copies of original statements and reports.

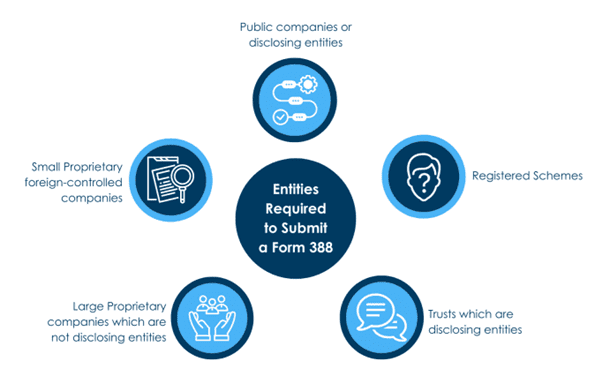

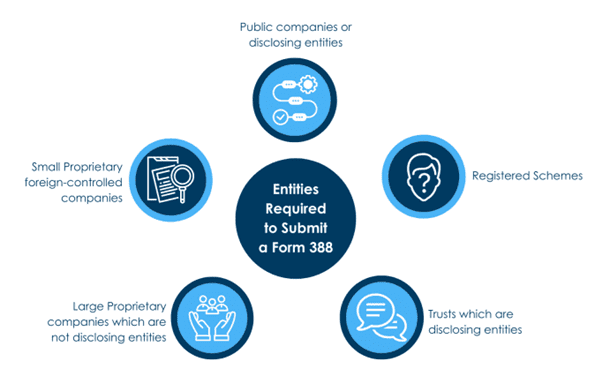

The entities required to submit Form 388 are:

Public companies and other disclosing entities.

Registered schemes and trusts.

Foreign companies registered in Australia.

Small proprietary foreign-controlled companies.

Large proprietary companies are also required to submit Form 388 if they (and the entities they control) satisfy at least two of the following three criteria:

Consolidated revenue of $50 million or more.

Gross assets of $25 million or more.

100 or more employees at the end of the financial year.

Small Proprietary Companies

Companies that do not satisfy two of the above criteria are considered “small” and are exempt from lodging financial statements and reports. However, in some circumstances, ASIC may still request they lodge if it has concerns over the company’s financial performance or compliance.

Other circumstances where a small proprietary company may be required to submit Form 388 include:

Shareholder request – shareholders who hold more than 5% of the company’s voting shares can request that the company file an annual financial statement.

Crowd-sourced funding – small companies that raise money via crowd-sourced funding (CSF) and issue shares to retail investors may also be required to prepare and lodge financial statements.

The purpose of Form 388 is to ensure that entities comply with their obligation to lodge financial statements and reports with ASIC. It is also the mechanism by which these important documents are submitted. In the process, the entity provides ASIC with a formal record of its financial performance and position.

This information promotes transparency and accountability with investors and creditors and also helps ASIC enforce financial standards if they are not met.

Entities required by ASIC to submit Form 388 (Source: Sophie Grace)

Entities required by ASIC to submit Form 388 (Source: Sophie Grace)

Deadlines for Form 388 submission depend on the type of entity.

Within 4 months of the end of the financial year:

Within 3 months of the end of the financial year:

Contact the auditor for an applicable timeframe:

Note that if the form is submitted late, a fee of $96 applies for all submissions less than a month after the due date. Forms submitted more than one month late will attract a late fee of $401.

Submission of Form 388 is free provided that the necessary documents are lodged by the due date. The only exception is the submission of a 388K Trust (disclosing entity) form, which attracts a lodgment fee of $1,485.

To view all applicable fees, learn more about the requirements for different entities or obtain a copy of the form, click here.

Summary:

An ASIC form is a standardised document used to report specific information to the Australian Securities and Investments Commission (ASIC). Form 388 is one such form used by companies to lodge annual financial statements and reports.

Entities required by law to submit Form 388 include public companies, registered schemes and trusts, small proprietary foreign-owned companies, and foreign companies registered in Australia. Small proprietary Australian companies may also be required to report in certain circumstances.

Form 388 plays a crucial role in ensuring that companies comply with Australian financial reporting regulations. Submission is free for most entity types, but fees do apply to trusts as well as any form lodged after the due date.

References

Are you a large or small proprietary company?

388 Copy of Financial Statements and Reports

Entities required by ASIC to submit Form 388 (Source:

Entities required by ASIC to submit Form 388 (Source: