Direct deposit is an electronic payment method where funds are transferred directly to a recipient’s bank account. In rare cases, money may be physically deposited into the payee’s account. Direct deposit is typically used by businesses to pay salaries or wages but can also serve as payment for services rendered. For consumers, the method is utilized for tax refunds and government benefits such as the pension.

How Direct Deposit Works

Here’s how direct deposit works in practice.

Initiation

The process starts with an event that initiates the direct deposit, such as payment of an employee’s monthly salary. In response, the payer (in this case, a business) collects the employee’s bank account number and Bank-State-Branch (BSB) number. The BSB number is a six-digit code that identifies the specific branch of an Australian bank or financial institution. It is also at this point that the amount to be transferred is entered.

Processing

Once the payment has been initiated, the payer's bank processes the request. The bank then sends the funds through an electronic clearing system to the bank of the recipient. In Australia, the system that deals with direct deposits (known as direct credits) is the Bulk Electronic Clearing System (BECS). It is managed by the Australian Payments Network and handles around $15 trillion worth of payments annually. Other less prominent systems include BPAY (for instant payments and bill payments) and PayPal.

Clearing and Settlement

On the BECS, payments between financial institutions are exchanged in batches six times per weekday at:

10:00 am

1:00 pm

4:00 pm

6:30 pm

8:45 pm

10:30 pm

Settlement of a direct deposit occurs on the same day with the exception of payments in the 10:30 pm batch. Note that same-day settlement in Australia was introduced in 2013 to reduce operational risk and enable financial institutions to better meet consumer needs.

Receipt

The recipient’s bank then credits the funds to their account and makes them available for withdrawal or other transactions.

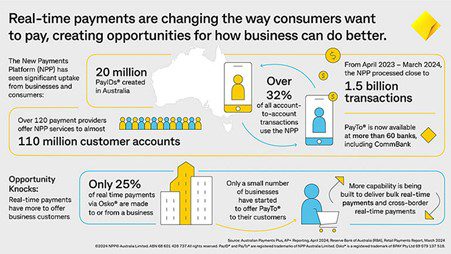

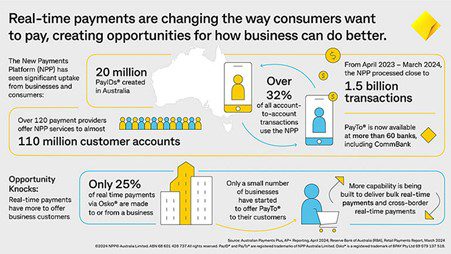

In 2018, the BPAY system introduced the near-real-time Osko payment service for eligible recipients. Osko is hosted on the New Payments Platform (NPP) – a fast payments infrastructure that runs nationwide and is utilized by over 100 banks, credit unions, fintechs, and other organizations. Central to the Osko direct deposit process is that payments are settled with a PayID – a simple, easy-to-use identifier such as an email address, mobile number, or ABN that avoids the need to remember bank account and BSB information.

An infographic from the Commonwealth Bank that highlights the increasing popularity of the New Payments Platform (Source: CBA)

Direct Deposit Use Cases

Direct deposit is a crucial component of Australia’s financial ecosystem because it provides a secure, efficient, and reliable way to make various types of payments. Use of direct deposit is widespread and evident in multiple sectors. Let’s take a brief look at them below.

Payroll

Payroll is one of the primary use cases for direct deposit. This method is secure, convenient, efficient, and avoids the human error associated with check-based systems in the US. While there is no legal requirement for Australian companies to pay their employees via direct deposit, most prefer to do so because it simplifies payroll processes and reduces administrative costs.

Government Payments

The Australian Government also uses direct deposit to distribute various types of payments such as unemployment benefits and the pension, among other payments. Tax refunds from the Australian Tax Office (ATO) are also paid via direct deposit into bank, credit union, and building society accounts.

Business Payments

In addition to paying their employees a salary or wage, businesses may use direct deposit to:

Pay vendors for goods and services

Pay taxes such as GST and payroll tax

Process customer refunds

Reimburse employees for business-related expenses

Make recurring payments for rent and utilities

Pay dividends to shareholders

Consumer Payments

Direct deposit is also favored by consumers in numerous contexts. Tenants and homeowners set up direct deposits to pay rent or mortgage automatically, which simplifies financial management and reduces the need to handle large sums of cash. In a similar vein, direct deposit is used to pay for utilities such as electricity and water. The ease with which direct deposits can be made again simplifies household budgets and also avoids service interruptions. Lastly, recurrent direct deposits can be established to make loan repayments or make periodic contributions to an investment or savings account.

Summary:

Direct deposit is an electronic payment method in which funds are transferred directly from one bank account to another. The method is a secure, efficient, and popular payment method in Australia.

Most direct deposits are made on the Bulk Electronic Clearing System (BECS) which is managed by the Australian Payments Network. Other payment facilitators such as BPAY offer bill payment and near-instant fund transfer services.

With no reliance on paper checks to pay salaries or wages, payroll is one of the main use cases for direct deposit in Australia. However, it is also extensively used by governments, consumers, and in many other business contexts.