Operating expenses, often abbreviated to OpEx in the finance world, refer to any costs incurred by a business related to its day-to-day operations (also known as operating activities). Essentially, these are activities related to running the business that may incur a cost.

Examples of Operating Expenses

Operating expenses will vary from business to business, depending on what the company does. Examples of operating expenses could include:

Salaries and wages

Office supplies

Office rent

Sales and marketing fees

Equipment maintenance and repairs

Cost of goods sold (COGS)

It’s important to note that operating expenses could vary depending on the business type, but to help narrow down examples, they don’t include expenses related to loans, borrowing, or investing.

Identifying Operating Expenses on an Income Statement

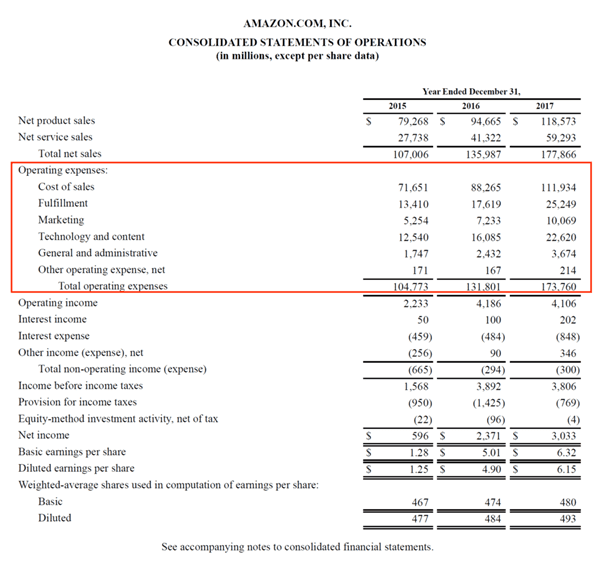

Looking to the Corporate Finance Institute, they showcase Amazon’s income statement. In this image, you can see how they claim operating expenses, as highlighted in red:

Types of Operating Expenses

Operating expenses can be either fixed costs or variable costs.

Fixed costs: Costs that do not change based on variables related to business, production, or output. An example of a fixed cost would be rent, as the space you’re in will cost the same per month (unless otherwise noted in a contract).Variable costs: Costs that fluctuate based on volume. An example of a variable cost would be production supplies, because the more you are producing, the more supplies you will need. Like with most businesses, production can fluctuate week-by-week; therefore, these costs will increase or decrease in accordance with these changes.

What are Non-Operating Expenses?

Non-operating expenses account for anything not related to the actual business operations. Stakeholders can put non-operating expenses in a separate bucket from operating expenses, so they can easily assess company performance without them. Examples of non-operating expenses include:

Debt

Restructuring costs

Lawsuit settlement payments

Inventory losses or write-offs

Losses on investments

Currency translation

Why Do Operating Expenses Matter?

It’s important for business owners to be aware of operating expenses so they can assess the profitability of their business model. Based on OpEx being a certain amount, the company knows they will need to make a specified percentage more to consider themselves profitable. OpEx can also lend a hand in pricing strategies to ensure margins on production are high enough to sustain the business.